|

||||

|

|

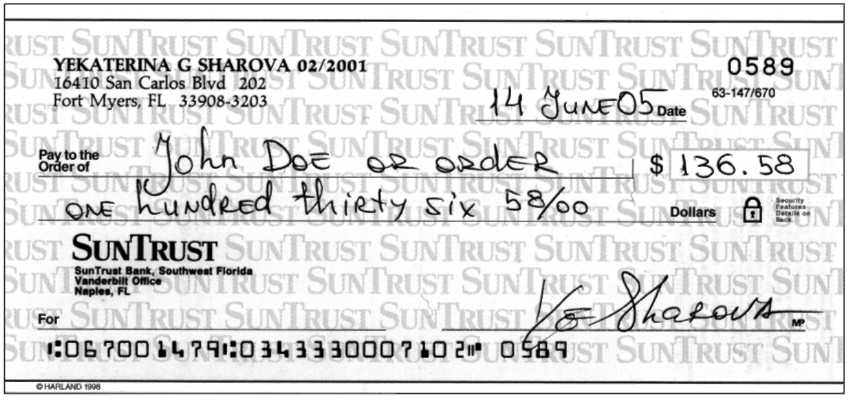

Unit 14 Checks and Bank Collections Чеки и инкассирование Чеком признается ценная бумага, содержащая ничем не обусловленное распоряжение чекодателя банку произвести платеж указанной в нем суммы чекодержателю (п. 1 ст. 877 ГК). Законодательство и практика чекового обращения знает несколько разновидностей чеков: по субъектам различаются чеки предъявительские, ордерные и именные; с точки зрения инкассации (получения денег) чеки подразделяются на кассовые, расчетные и кроссированные. Участниками отношений по чеку являются чекодатель, чекодержатель и плательщик. Чекодателем считается лицо, выписавшее чек; чекодержателем – лицо, являющееся владельцем выписанного чека. Плательщиком по чеку является банк, где чекодатель имеет средства, которыми он вправе распоряжаться путем выставления чеков (это могут быть деньги, находящиеся на банковском счете, учтенный вексель, даже открытый кредит). Использование чеков в качестве инструмента безналичных расчетов должно основываться на чековом договоре между плательщиком и его банком, а также между банками – участниками чековых расчетов. List of key terms and word combinations: A check is a draft drawn on a bank and payable on demand. It is the most common form of a draft. It is drawn on a bank by a drawer who has an account with the bank to the order of a specified person or business named on the check or to the bearer. A check is a safe means of transferring money, and it serves as a receipt after it has been paid and canceled by the bank. In the check shown in Figure 1, Ms. Sharova is the drawer; she has an account in the Sun Trust Bank. John Doe is the payee. Sun Trust Bank, on which the check is drawn, is the drawee.  Ownership of a check may be transferred to another person by endorsement by the payee. In this manner, a check may circulate among several parties, taking the place of money. A bank must honor a check when it is properly drawn against a credit balance of the drawer. Failure to do so would make the bank liable to the drawer for resulting damages. Special types of checks have been developed for use in particular situations. These checks include bank drafts, traveler's checks, and cashier's checks. A bank draft, sometimes called a teller's check, or treasurer's check, is a check drawn by one bank on another bank in which it has funds on deposit in favor of a third person, the payee. Many banks deposit money in banks in other areas for the convenience of depositors who depend upon the transfer of funds when transacting business in distant places. When the buyer is unknown to the seller, such checks are more acceptable than personal checks. A cashier's check is a check drawn by a bank upon itself. The bank, in effect, lends its credit to the purchaser of the check. People who will not accept personal checks will often accept cashier's checks. Such a check may be made payable either to the depositor, who purchases it from the bank, or to the person who is to cash it. If the check is made payable to the depositor, it must be indorsed to the person to whom it is transferred. A traveler's check is similar to a cashier's check in that the issuing financial institution is both the drawer and the drawee. The purchaser signs the checks in the presence of the issuer when they are purchased. To cash a check, the purchaser writes the name of the payee in the space provided and countersigns it in the payee's presence. Only the purchaser can negotiate traveler's checks, and they are easily replaced by the issuing bank if they are stolen. A certified check is a check that is guaranteed by the bank. At the request of either the depositor or the holder, the bank acknowledges and guarantees that sufficient funds will be withheld from the drawer's account to pay the amount stated on the check. A prudent person would request a certified check when involved in a business transaction with a stranger rather than accept a personal check. A check may be postdated when the drawer has insufficient funds in the bank at the time the check is drawn but expects to have sufficient funds to cover the amount of the check at a future date. Postdating is also practiced when some act or performance is to be completed before the date for payment of the check. Such a check, at the time it is drawn, has the effect of turning a demand instrument into a time instrument because it is an order to pay a specified amount of money at the future date stated. A popular method of banking, known as electronic fund transfers (EFTs), uses computers and electronic technology as a substitute for checks and other banking methods. During the bank collection process, banks are described by different terms, depending on their particular function in a transaction. The different terms that are used to describe banks and their meanings are as follows: Depositary bank is the first bank to which an item is transferred for collection even though it is also the payor bank. Payor bank describes a bank by which an item is payable as drawn or accepted. It includes a drawee bank. Intermediary bank defines any bank to which an item is transferred in the course of collection except the depositary or payor bank. Collecting bank means any bank handling the item for collection except the payor bank. Presenting bank is any bank presenting an item except a payor bank. Remitting bank describes any payor or intermediary bank remitting for an item. The life cycle of a check begins when the drawer writes a check and delivers it to the payee. The payee may take the check directly to the payor bank (the bank on which it was drawn) for payment. If that bank pays the check in cash, its payment is final, and the check is returned to the drawer with the next bank statement. However, it is more likely that the check will be deposited in the payee's own account in another bank. That bank, known as the depositary bank, acts as its customer's agent to collect the money from the payor bank. Any settlement given by the depositary bank in this case is provisional (not final). It may be revoked if the check is later dishonored. The check is sent (sometimes through an intermediary bank) to a collecting bank, which presents the check to the payor bank for payment. If it is honored by the payor bank, the amount will be deducted from the drawer's account and the check will be returned to the drawer with the next bank statement. If the check is dishonored for any reason, it will be returned to the payee via the same route that it was sent and all credits given for the item will be revoked. The relationship between the drawee bank and its customer is that of both debtor and creditor and agent and principal. The relationship arises out of the express or implied contract that occurs when the customer opens a checking account with the bank. The bank becomes a debtor when money is deposited in the bank by the customer. At this time, the customer is owed money by the bank and is, therefore, a creditor. When an overdraft occurs, that is, when the bank pays out more than the customer has on deposit, the debtor-creditor role reverses, and the bank becomes the creditor. The bank acts as the customer's agent when it collects or attempts to collect checks or other negotiable instruments made payable to the customer. The drawee bank is under a duty to honor all checks drawn by its customers when there are sufficient funds on deposit in the customer's account. If there are insufficient funds on deposit, the bank may charge the customer's account even if it creates an overdraft. A bank is under no obligation to a customer to pay a stale check unless it is certified. A stale check is a check that is presented for payment more than six months after its date. A bank, however, may honor a stale check without liability to its customer if it acts in good faith. A forgery is the fraudulent making or alteration of a writing. A forgery is committed when a person fraudulently writes or alters a check or other form of commercial paper to the injury of another. The commission of forgery is a crime, subject to a fine and imprisonment. The offering of a forged instrument to another person when the offerer knows it to be forged is also a crime, known as uttering. If a bank, in good faith, pays the altered amount of a check to a holder, it may deduct from the drawer's account only the amount of the check as it was originally written. The depositor is also protected against a signature being forged. When a checking account is opened, the depositor must fill out a signature card, which is permanently filed at the bank. Thereafter, the bank is held to know the depositor's signature. The bank is liable to the depositor if it pays any check on which the depositor's signature has been forged. Payor banks are required to either settle or return checks quickly. If they do not do so, they are responsible for paying them. If the payor bank is not the depositary bank, it must settle for an item by midnight of the banking day of receipt. If the payor bank is also the depositary bank, it must either pay or return the check or send notice of its dishonor on or before its midnight deadline. In this case, the bank's midnight deadline is midnight of the next banking day following the banking day on which it receives the relevant item. Depositors, in general, owe a duty to the banks in which they have checking accounts to have sufficient funds on deposit to cover checks that they write. They must also examine their bank statements and canceled checks promptly and with reasonable care and notify the bank quickly of any discrepancies. Many banks now offer overdraft protection service to their depositors, which cover small overdrafts that are usually caused by the mistake of the drawer in balancing the checkbook. With this service, the bank honors small overdrafts and charges the depositor's account. This service saves the drawer the inconvenience and embarrassment of having a check returned to a holder marked insufficient funds.» Depositor has a duty to examine their bank statements and canceled checks promptly and with reasonable care when they are received from the bank. They must report promptly to the bank any forged or altered checks. If they do not do so, depositors cannot hold the bank responsible for losses due to the bank's payment of a forged or altered instrument. Drawers may order a bank to stop payment on any item payable on their account. If a bank fails to stop payment on a check, it is responsible for any loss suffered by the drawer who ordered the payment stopped. The bank, however, may take the place of any holder, holder in due course, payee, or drawer who has rights against others on the underlying obligation. This right to be substituted for another is known as the bank's right of subrogation. It is designed to prevent loss to the bank and unjust enrichment to other parties. Exercise 1. Comprehension questions: 1. Give definition of a check. 2. Identify special types of checks. 3. Identify the parties relating to a check. 4. What do the cashier's check and traveler's check have in common? 5. What are the requirements for traveler's check? 6. Explain what a certified check is. 7. In what situation postdating is practiced? 8. What are the benefits of electronic fund transfers? Exercise 2. Find in the text English equivalents to the following: Тратта, выставленная одним банком на другой; чек – выписанный банком на себя; чек с надписью банка о принятии к платежу; банк-инкассатор; банк-депозитарий; подлог; банк-посредник; превышение кредита; банк-плательщик; банк-представитель; банк, переводящий средства; просроченный чек; замена одного кредитора другим; чек, выписанный банком на другой банк и подписанный кассиром банка, выписавшего чек; переуступка Exercise 3. Consult recommended dictionaries and give words or phrases to the following definitions: Чекодержатели; выставление чеков; выдача чеков; отзыв чека; реквизиты чека; оплата чека; депонирование средств; индоссированный чек; утраченный чек; подложный чек; передача прав по чеку; переводной чек; инкассирование чека; аваль чека; операции по счету; кредитование счета; оплата услуг банка; банковская комиссия; списание денежных средств со счета. Exercise 4. Be ready to talk on one of the following topics: 1. Explain the form necessary for an instrument to be a check. 2. Differentiate between a bank draft and a cashier's check. 3. Compare the liability of parties to a check certified by the drawer with that of a check certified by the payee. 4. Outline a check's life cycle. 5. Explain the duties of a depositor relative to bad checks and examining accounts. Exercise 5. Make up your own dialog on the case: In Cambridge Trust Co. v. Carney, defendant was a cosignatory with her husband on his business account in order to «insure» payment pursuant to a preliminary support agreement. After receiving an initial payment of $38,000, defendant neither deposited money in, withdrew money from nor received any statement from the bank regarding the joint account. Three month after the initial payment, defendant's husband deposited worthless check for $7,100, drew $6,000 against it, and disappeared into the gloaming. Bank sued defendant on the$5,902.88 overdraft. The New Hampshire Supreme Court held that since defendant neither participated in the transaction creating the overdraft nor received funds as a result of it, she could not be held liable for payment of it. |

|

||

|

Главная | Контакты | Нашёл ошибку | Прислать материал | Добавить в избранное |

||||

|

|

||||